Systems and Organizational Control (SOC) is one of the most important attestations for service organizations. It is a report by an independent accounting and auditing firm that measures the effectiveness of internal controls over financial reporting in place at a service organization. The SOC 1 report is used by organizations to communicate information about their internal controls to their customers and business partners.

The SOC 2 report is used by organizations to communicate information about their internal controls to their regulators and other interested parties. The SOC 3 report is a public version of the SOC 2 report that can be used by organizations to communicate information about their internal controls to the general public.

If you are a service organization, then you should know about SOC Compliance and how to meet the requirements. This guide will help you understand the basics of SOC Compliance and get you started on the right path.

What Does SOC Certified Mean?

SOC compliance has become increasingly important in recent years as businesses have become more reliant on technology and data. Cyber threats and data breach incidences are on the rise. Companies must protect their customers’ sensitive information. SOC certification allows businesses to demonstrate their commitment to security. It helps assure their clients that they have taken the necessary steps to secure their data.

While storing customer data is a common practice, it comes with a significant risk level. Customer data is often sensitive. Once it gets leaked and misused by cybercriminals, it can cause significant harm to both customers and the business. Therefore, the need to ensure they store customer data accordingly and securely is highly critical.

SOC certification requires rigorous security assessment that covers various aspects of a business’ security posture. This includes policies and procedures, access control, risk management, incident response, and more. The certification process can be elaborate and time-consuming. It also requires a significant investment. But in the end, it’s all worth it if you are serious about demonstrating demonstrate commitment to security as well as building trust with your clients.

One benefit of SOC certification is that it helps organizations identify potential security risks before they become a problem. The comprehensive security assessment can identify areas where they need to improve their security posture and implement the necessary changes to reduce their risk of a data breach.

Another benefit of SOC certification is that it can help organizations meet regulatory requirements. Industries such as healthcare, finance, and government have strict regulations that require organizations to implement specific security measures and demonstrate their commitment to security. SOC certification assures that an organization has met these requirements and is operating securely and competently.

What is SOC Compliance Audit?

SOC compliance audit is an evaluation of an organization’s compliance with regard to specific control objectives. SOC compliance audits are relevant to all organizations, regardless of their size or industry. The purpose of a SOC compliance audit is to assess the risks associated with an organization’s use of personally identifiable information and communication technology (ICT) and to ensure that these risks are appropriately managed.

SOC compliance audits are conducted by independent, third-party auditors. The scope of a SOC compliance audit depends on the organization being audited, but may include an evaluation of the organization’s policies, procedures, and controls related to ICT. Auditors will also typically interview staff and review documentation to verify compliance with SOC requirements.

What is the Main Purpose of SOC?

The main purpose of SOC compliance is to ensure that organizations are adhering to best practices in terms of security and data protection. By adhering to SOC compliance standards, organizations can minimize the risks associated with data breaches and other security threats. In addition, SOC compliance can also help organizations to improve their overall security posture and better protect their data assets.

When undergoing SOC compliance and certification, organizations can expect the following areas to be checked:

- Security controls: Implementation of a set of security controls, such as firewalls, encryption, and access controls, to protect sensitive data.

- Data protection: Implementation of processes and controls to ensure the confidentiality, integrity, and availability of sensitive customer information and data, such as backup and disaster recovery processes.

- Access controls: Implementation of controls to ensure that only authorized individuals have access to sensitive data, and that access is restricted based on the principle of least privilege.

- Monitoring and logging: Detecting and responding to security incidents. This includes data breaches or unauthorized access to customer information.

- Incident response: Having a well-defined incident response plan in place to respond to security incidents, including how to avoid data breaches and other security threats.

- Business continuity and disaster recovery: Organizations should have a response plan in the event of a disaster, such as a fire or a flood. This ensures sensitive data will remain protected in spite of emergency situations.

What are the Different Types of SOC Reports?

SOC 1

A SOC 1 report is an evaluation of a service organization’s internal controls that are relevant to financial reporting. The report is used by service organizations to demonstrate their compliance with FINRA, SEC, and SOX regulations. SOC 1 reports are prepared by independent accounting firms and are intended for use by the service organization’s clients and regulators.

When do you need SOC 1?

SOC1 is typically required when an organization is relying on the controls of a service organization to achieve accurate financial reporting. Companies will want to be sure that the service organization has proper security controls in place and that they are working correctly so that the financial reports they produce will be accurate.

SOC 2

SOC2 (Service Organization Control 2) compliance is a set of auditing and reporting standards that evaluates a service provider’s information systems and controls related to security, availability, processing integrity, confidentiality, and privacy. SOC 2 is specifically targeted towards businesses that store or handle sensitive customer data, such as healthcare providers, financial institutions, and software as a service (SaaS) companies. SOC2 compliance is based on the Trust Services Criteria developed by the American Institute of CPAs (AICPA) and is meant to ensure that service providers meet regulatory requirements and maintain a high level of security and data protection for their clients.

When do you need SOC 2?

SOC 2 is useful for any companies that handle sensitive company data and want to demonstrate to their customers/clients their ability to protect data through proper security controls.

SOC 3

SOC3 is a public report of internal controls over security availability, integrity and confidentiality. SOC3 is similar in that it focuses on cybersecurity controls but this report is less intensive and it is designed to be shared publicly.

According to the AICPA, “designed to meet the needs of users who need assurance about the controls at a service organization relevant to security, availability, processing integrity, confidentiality, or privacy, but do not have the need for or the knowledge necessary to make effective use of a SOC 2 Report.”

When do you need SOC3?

SOC 3 compliance reports don’t provide the same level of detail about company systems and controls as SOC 2. SOC 3 is generally used as a marketing tool, it can be provided to prospective customers to provide them with a general idea of the companies security practices and adherence to best practices.

SOC for Cybersecurity

The AICPA’s SOC for Cybersecurity (SOC 2) is the most comprehensive and rigorous security certification for organizations that store, process, or transmit sensitive customer data. SOC 2 certification provides an independent, third-party assessment of an organization’s security controls and procedures. Unlike other security certifications, SOC 2 certification specifically focuses on how an organization safeguards and store customer data based.

Organizations that undergo SOC 2 certification must meet stringent security requirements in five key areas:

- Security

- Availability

- Processing Integrity

- Confidentiality

- Privacy

SOC 2 certification is recognized by major tech companies, including Microsoft, Amazon, and Salesforce. It is also trusted by leading financial institutions, such as Wells Fargo and JP Morgan Chase.

Type 1 and Type 2 Reports

For each category of SOC report you have the option of doing a type 1 or type 2 report. A Type 1 report is a point-in-time assessment of your organization’s security controls to ensure they are working correctly while a Type 2 report looks at the effectiveness of those same controls over an extended period time, typically 12 months.

How Do You Know What Type of SOC Report You Need?

The type of of report that you choose to go for is up to the company. The type 2 report provides the greatest level of assurance to your customers/partners that your company is living up to security best practices but it has the drawback of being very time-consuming. A point-in-time assessment gives a lower level of assurance but it is much less intensive than the type 2 report and much quicker to obtain.What is the Benefit of Obtaining an SOC Report?

One significant advantage of a SOC report is the enhanced data security it provides. By conducting a thorough assessment of an organization’s cybersecurity policies, procedures, and controls, a SOC report helps businesses identify vulnerabilities and potential threats. For example, a financial services firm may discover that its customer data is at risk due to inadequate encryption methods. This prompts them to implement more robust security measures to protect their clients’ information better.

Furthermore, a SOC report offers organizations invaluable insights into potential risks, allowing them to proactively address vulnerabilities and strengthen their security posture. In a retail context, this might involve examining the potential for data breaches in point-of-sale systems or online payment portals. By identifying these risks early, businesses can work to mitigate them before they become critical issues, safeguarding their reputation and customer confidence in the process.

Customer trust and confidence are essential for any organization, and a SOC report can play a pivotal role in fostering these attributes. For instance, a healthcare provider storing sensitive patient data may use a SOC report to demonstrate their commitment to maintaining the highest standards of data security and privacy. As a result, patients and partners are more likely to trust the organization.

Moreover, SOC reports can assist organizations in passing third-party audits and obtaining certifications, such as the ISO 27001 or the Payment Card Industry Data Security Standard (PCI DSS). These certifications are often required by clients, partners, or regulatory bodies and can provide a competitive edge in the marketplace. A technology company looking to expand its client base may leverage a SOC report to prove compliance with industry-specific security standards and win new business.

What Can I Expect During the SOC Examination?

During a SOC (System and Organization Controls) examination, you can expect several stages that will help assess your company’s internal controls and processes, providing valuable insights into the effectiveness of your cybersecurity measures.

- Pre-assessment phase: Prior to the actual examination, the independent accounting firm will typically conduct a preliminary assessment. This phase involves gathering information about your company’s operations, IT infrastructure, and risk environment. Your company should be able to provide documentation to facilitate this process including policies, procedures, and organizational charts.

- On-site review: An in-depth review of your internal controls and processes will be conducted by the accounting firm during the on-site review. This may include examining physical security measures, access controls, data backup and recovery procedures, and network security measures. The auditors may also observe employees in action to ensure that they are following established procedures and protocols.

- Testing of internal controls: This test helps determine your internal controls’ effectiveness in preventing and detecting errors, fraud, and other irregularities. This testing may involve reviewing system logs, analyzing access controls, and examining incident response procedures. In some cases, the auditors may use penetration testing or vulnerability scanning to assess the strength of your cybersecurity measures.

- Employee interviews: The auditors will conduct interviews with employees from various departments to get insights into their understanding of company policies, procedures, and internal controls. These interviews can reveal potential gaps in employee knowledge and training, which may contribute to weaknesses in your cybersecurity posture.

- Reporting: Upon completion of the SOC examination, the independent accounting firm will issue a report based on the AICPA’s SOC attestation standards.

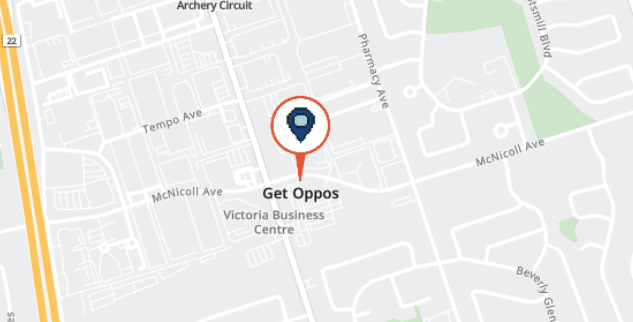

Get SOC Compliant with Oppos!

There are many factors to consider when beginning the journey to SOC compliance. This guide provided an overview of some of the most important steps to take. To ensure you are on the right track, subscribe to our newsletter for more tips.

Protect customer data today! Schedule a call with us at Oppos Cybersecurity Experts and inquire about our privacy compliance services. We offer SOC 1 and SOC 2 compliance services, and we’ll be able to assist you through certification.

Don't wait – secure your data and boost customer confidence with Oppos' SOC compliance services.

SOC Compliance FAQs

SOC Compliance isn’t necessary for business but it aids in giving customers and partners confidence in your data security practices. Organizations that should comply with SOC compliance include banks, credit card companies, healthcare providers, and retailers.

The AICPA is the organization that manages SOC compliance. The AICPA sets the standards for SOC compliance and provides guidance on how to comply with them. If you are looking to comply with SOC, you should consult with the AICPA to ensure that you are meeting all of the requirements.

Three types of SOC Compliance SOC 1,2 & 3. SOC1 compliance is designed for businesses that handle financial data, while SOC2 compliance is focused on testing cybersecurity controls for businesses that handle sensitive customer data. SOC3 compliance is a less intensive version of SOC2 that is designed for public distribution.

SOC 2 compliance is built on three pillars: security, availability, and confidentiality. Organizations must implement safeguards in each of these areas in order to meet SOC 2 requirements.