What is PCI?

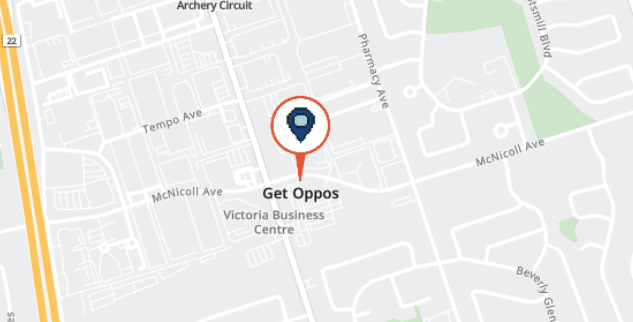

The Payment Card Industry standard is the most widely accepted security framework for companies handling, processing, or storing credit card information.

The framework is maintained by the PCI Security Standards Council, which was founded by American Express, Discover, JCB International, MasterCard and Visa Inc.in 2006 to protect cardholder data and reduce incidences of credit card fraud.

The framework has multiple specific standards depending on where your organization fits within the credit card payment ecosystem.

| Standard | Description | Typical Customer |

|---|---|---|

| PCI DSS | Security standards for payment cards. |

|

| PCI SSF | Standards promoting payment software security. |

|

| PA-DSS | Requirements for secure payment apps. |

|

| PCI P2PE | Payment data encryption for security. |

|

| PCI DSS ASV | Approved vendor for external scanning. |

|

Oppos can assess your organization against any PCI standard and work with you to either attain or maintain PCI compliance regardless of the size and complexity of your payment card-related responsibilities. This includes working with your approved PCI Assessor or, if you qualify, working with you to complete a Self-Assessment Questionnaire (SAQ).

Oppos Cybersecurity Compliance Experts in Canada are committed to ensuring your business meets the stringent requirements of PCI compliance. With the increasing use of credit card transactions, it’s important to protect sensitive financial information and prevent unauthorized access to it. This is why we provide a wide-ranging suite of cybersecurity services, including comprehensive Payment Card Industry (PCI) assessments.

We offer our clients an all-inclusive service package that extends beyond mere compliance—focusing on long-term strategies for protecting sensitive financial data. Our expertise spans various PCI standards, such as PCI DSS, PCI SSF, PA-DSS, PCI P2PE, and PCI DSS ASV scanning, making us a trusted payment industry partner.

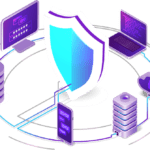

Data breaches could have severe implications for your business, affecting your bottom line and your reputation. Because of this, our services ensure that you maintain secure systems, employ strong access control measures, and regularly test security systems. Our experts are adept at identifying potential gaps, preparing requisite documentation, conducting internal and external audits, and providing technical support.

We believe in a comprehensive approach to cardholder data security, which involves implementing security controls and parameters that restrict both physical access and computer access to stored cardholder data. Not only does this help prevent data breaches; but it also ensures your alignment with the security standard PCI DSS and other relevant security standards.

At Oppos, our commitment is to ensure that your credit card processing systems are robust and secure. We work alongside credit card companies to maintain secure systems and protect sensitive data. Our cybersecurity services are designed to offer you peace of mind.

Partner with us today to safeguard your business against the ever-evolving cybersecurity threats in the payments industry. Call us at Oppos for a PCI assessment today. Trust us to secure your future in the payments industry.

Why is PCI Compliance Important?

The protection and security of payment cardholder data must always be the foremost concern for businesses. PCI DSS compliance is essential for safeguarding cardholder data and safely handling sensitive authentication data. Non-compliance with the PCI Data Security Standards can lead to severe consequences. This includes loss of customers, damage to brand reputation, legal actions, and financial losses. Your business can effectively defend itself against cyber threats and data breaches by achieving and maintaining PCI compliance.

At Oppos, we specialize in helping businesses navigate the PCI compliance process efficiently and comprehensively. With our PCI assessment and compliance services, you can have peace of mind knowing that your credit card data, along with your customers’ information, is secure.

With over 60 years of combined experience in the cybersecurity industry, we have assisted numerous businesses in protecting stored cardholder data through our PCI assessment and compliance services. Our in-depth knowledge of PCI DSS requirements enables us to identify potential risks and vulnerabilities in your IT environment and provide recommendations to mitigate them. We conduct vulnerability assessments, penetration testing, and software architecture reviews to ensure your payment processing applications are secure and compliant with PCI DSS standards.

We also help businesses implement security parameters, restrict physical access to cardholder data, and establish secure methods to transmit cardholder data. Our goal is to guide your business through the process to validate PCI compliance effectively and efficiently.

How Do I Become PCI-Compliant?

If you are a merchant who accepts credit card payments or a service provider to merchants, you are responsible for adhering to PCI Data Security Standards. Here’s a guide on how to become PCI-compliant.

- Build secure networks and systems using network security controls and safe system configurations.

- Safeguard cardholder data by encrypting during transmission and storage.

- Set up a vulnerability management program to defend against malware and guarantee secure internal development procedures.

- Enforce strong access controls by limiting system and data access according to the need-to-know principle, implementing user identification and authentication best practices, and restricting physical access to systems and cardholder data.

- Regularly evaluate and test network and system security and preserve and secure logs and test reports.

- Establish a security policy that outlines standards and expectations for the organization.

The PCI Security Standards Council suggests a three-step process for PCI compliance:

- Assess – Take inventory of sensitive cardholder data, processes, and assets related to payment processes. Identify security vulnerabilities and record any issues found.

- Remediate – Address security concerns by following PCI requirements. Focus on eliminating security vulnerabilities and limit storage of sensitive data as much as possible.

- Report – Document the entire process and produce the necessary reports. Submit the reports to the relevant financial institutions or card brands to achieve PCI certification.

Oppos PCI Compliance Services

Oppos is a trusted PCI assessment and compliance service provider, helping businesses and payment software vendors meet the stringent PCI DSS compliance requirements. As one of Canada’s leading cybersecurity compliance companies, Oppos delivers a comprehensive suite of services that includes:

- Determining the extent of PCI compliance requirements specific to your business

- Enhancing security policies and procedures to safeguard cardholder data effectively

- Evaluating and improving employees' security awareness related to handling sensitive authentication data

- Assessing the security of IT infrastructure and software, with a focus on protecting stored cardholder data

- Implementing PCI DSS-mandated security measures, including restricting physical access to cardholder data and setting robust security parameters

- Assuring continuous PCI DSS compliance through routine testing and updates

- Provisioning of complementary services such as security awareness training and penetration testing of applications and network infrastructure

Oppos also provides services for payment software vendors to establish a secure software development environment. This includes designing secure software architecture and identifying and addressing software security vulnerabilities throughout the software development life cycle.

Secure your customers’ credit card data and validate PCI compliance with Oppos’ PCI assessments. Get in touch with us to learn how we can help your business become and remain PCI DSS compliant. Protect your business and your customers by ensuring the highest data security and compliance standards.

“A large Telco client of ours required Moveable Online undergo a PCI-DSS gap assessment. After asking around within our circle or business associates, we were introduced to Oppos. They were able to aid us with the gap assessment, make recommendations to secure our environment and help prepare the documentation our client required. The process was quick, informative and we will engage Oppos for future compliance related activities, primarily our efforts with achieving PCI-DSS compliance.”

“They weaved in a layer of security that we had only dreamed of in the past – a next generation rewall — which they built, congured and deployed at the perimeter of our network. When called upon, even with the great distance between us, they provide onsite or remote support as required and always meet the mark. Since the time of our initial project, we have called upon Oppos several times for various IT and Security related projects which they have delivered on every time.”

Don't leave your business at risk! Ensure your security with PCI Assessments.

PCI Assessments FAQS

PCI compliance is assessed by reviewing an organization’s adherence to the Payment Card Industry Data Security Standards (PCI DSS). This is typically done through a third-party assessment or self-assessment questionnaire.

Any organization that accepts payment cards needs a PCI assessment to ensure compliance with PCI DSS.

Any organization that stores, processes, or transmits payment card data is subject to PCI requirements. This includes merchants, service providers, and payment processors.

While PCI compliance is not required by law, it is mandated by the payment card companies (Visa, Mastercard, American Express, etc.) and failure to comply can result in significant fines and penalties.

If an organization fails to comply with PCI DSS, they may face fines, increased transaction fees, and the potential loss of the ability to accept payment cards. In addition, a breach resulting from non-compliance could lead to legal action and damage to the organization’s reputation.