In the current digital landscape, securing financial and confidential information as well as maintaining its confidentiality and privacy is paramount. At Oppos Cybersecurity Compliance, we specialize in offering SOC 1 Compliance Attestation Services with unparalleled expertise. Our tailored approach ensures that your organization meets and exceeds rigorous standards. Trust us to safeguard your financial reporting processes.

Our SOC 1 attestation service is designed to give your stakeholders the confidence they need in your internal controls over financial reporting (ICFR). By partnering with Oppos, you’ll benefit from a comprehensive evaluation that identifies and mitigates potential risks, enhancing your operational efficiency and integrity. Our experienced SOC subject matter experts bring a wealth of knowledge and expertise, ensuring a smooth and efficient audit process that minimizes disruptions to your daily operations.

At Oppos, we understand that every organization’s needs are unique. We provide tailored solutions that align with your unique business goals and regulatory needs. Our strength lies in our dedication to quality, customer-focused approach, and capacity to offer practical insights that enhance performance and compliance.

SOC 1 compliance is more than just a regulatory obligation; it is a competitive edge. It indicates to your clients, investors, and partners that you are dedicated to maintaining the highest financial information security and control levels. When you choose Oppos to handle your SOC 1 attestation requirements, you are not just adhering to standards but setting a standard for trust and security in your industry.

Let Oppos guide your business operations to achieve and maintain SOC 1 compliance, ensuring security, reliability, and trustworthiness.

What is a SOC 1 Report?

A SOC 1 (Service Organization Control 1) is an audit report that assesses the internal controls of a service organization that are pertinent to their clients’ financial reporting. It is particularly designed for North American businesses that handle or manage financial information for their clients. A SOC 1 report is critical to ensuring the integrity and confidentiality of financial data.

This report has been developed based on the standards set by the American Institute of Certified Public Accountants (AICPA). These guidelines are designed to ensure that financial statements are accurate and reliable. It is particularly relevant for companies that outsource tasks such as bookkeeping or financial analysis, as these activities can significantly impact the accuracy of their financial statements.

The report provides a detailed assessment of a company’s financial statements, including an analysis of its assets, liabilities, and equity. It also includes evaluating the company’s internal controls and risk management processes. This information is critical for stakeholders, including investors, lenders, and regulators, who rely on accurate financial statements to make informed decisions.

The primary objective of a SOC 1 report is to provide confidence to your clients, their auditors, and stakeholders that your organization has implemented sturdy and effective controls related to financial reporting. This is particularly crucial for North American businesses operating in financial services, payroll processing, and cloud computing services, where trust and integrity are of utmost importance.

Why Do You Need to be SOC 1 Compliant?

Ensuring SOC 1 compliance is not just a regulatory requirement; it’s a strategic decision that establishes your service organization as a reliable partner in the financial ecosystem. SOC 1 compliance demonstrates effective internal controls and ensures financial reporting integrity. It is crucial for service organizations handling financial information of user entities.

When your organization achieves SOC 1 compliance, you have established and maintained a robust control environment that meets strict standards for design and operating effectiveness. This is not just about completing checklists; it’s about creating a foundation of trust with your clients, assuring them that their financial data is safe with you. By undergoing a SOC 1 audit by a certified public accountant, you demonstrate your organization’s commitment to protecting client data, managing risks effectively, and ensuring processing integrity.

But SOC 1 compliance goes beyond protecting client data; it’s about enhancing your competitive edge. Adhering to established control objectives can set you apart in a marketplace where trust and security are non-negotiable. It reassures clients and stakeholders that your organization prioritizes financial controls, operates effectively, and adheres to high financial reporting and data protection standards.

Furthermore, SOC 1 compliance helps to improve your business processes, simplify vendor management programs, and comply with regulatory oversight. It offers a well-defined structure for identifying and accomplishing control objectives, ensuring that your service organization’s system operates effectively and is in harmony with user entities’ internal control for financial reporting.

- Enhanced Trust with Clients

- Competitive Advantage

- Improved Internal Controls

- Reduced Risk of Financial Misstatements

- Streamlined Vendor Management

- Operational Efficiency

- Regulatory Compliance

- Attract and Retain Investors

- Market Differentiation

- Preparedness for External Audits

Who Needs a SOC 1 Audit?

Technology-Based Service Organizations

If your company provides Software as a Service (SaaS), cloud computing services, or data processing services, SOC 1 compliance is crucial to ensure the security and integrity of your service delivery.

Technology-Based Service Organizations

Organizations providing financial services that affect clients’ financial reporting require SOC 1 audits to validate internal controls and operational effectiveness, such as payroll processing or loan servicing.

Outsourcing Firms

Companies that handle outsourced operations affecting client data must undergo SOC 1 audits to exhibit control effectiveness and reliability, such as customer service, accounting, or HR services.

Data Centers

If your organization offers data storage or management services, a SOC 1 audit ensures that your client’s financial information is handled securely and controlled.

When Do You Need SOC 1 Reports?

An annual SOC 1 audit is essential to ensure continual compliance and identify any necessary changes or improvements in your control environment. However, specific client requests, regulatory requirements, or significant changes to your services or internal controls may also impact the timing of the audit. A comprehensive readiness assessment should be conducted to prepare for a formal audit to identify and address potential gaps in your organization’s internal controls.

For North American businesses in the industries highlighted above, SOC 1 audits represent a strategic move towards achieving operational excellence, building trust with clients, and gaining market leadership. Proactive measures should be taken to demonstrate a commitment to financial security and excellence rather than waiting for it to become a requirement.

Types of SOC 1 Reports

Type 1 Report

A Type 1 report assesses and documents a service organization’s system and the suitability of the design of its controls at a specific point in time. This report focuses on the organization’s description of its controls and determines whether they are correctly designed to achieve the desired control objectives. However, it does not evaluate the effectiveness of these controls over time. Organizations often use Type 1 reports to demonstrate their control environment quickly and efficiently to clients or potential clients.

Type 2 Report

A Type 2 report is a more detailed version of a control assessment that evaluates the adequacy of control design and its operational effectiveness. This type of audit typically spans over a minimum of six months. It involves thorough testing of an organization’s controls to ensure they function as intended and effectively manage risks related to financial reporting. Type 2 reports are essential for organizations that want to provide their clients with a higher level of assurance regarding their control environment.

Ensuring SOC 1 Compliance with Oppos

Why Choose Oppos for SOC 1 Compliance?

Leverage our compliance experts’ deep expertise in SOC 1 attestation to ensure impeccable financial reporting processes.

At Oppos, we understand that every service organization is unique. Our approach is to identify and implement control objectives and internal controls tailored to your specific system, ensuring precise alignment with SOC 1 requirements.

Our streamlined readiness assessment and audit process make achieving compliance smooth and hassle-free, minimizing disruptions to your operations while maximizing efficiency.

Our comprehensive approach covers all aspects, from evaluating internal controls to ensuring the processing integrity of financial data, to produce a reliable SOC 1 report.

Oppos partnership involves proactive risk identification and mitigation to safeguard your finances and controls.

Achieving SOC 1 compliance with Oppos fortifies internal control and financial reporting processes, builds trust with user entities, and opens new business opportunities.

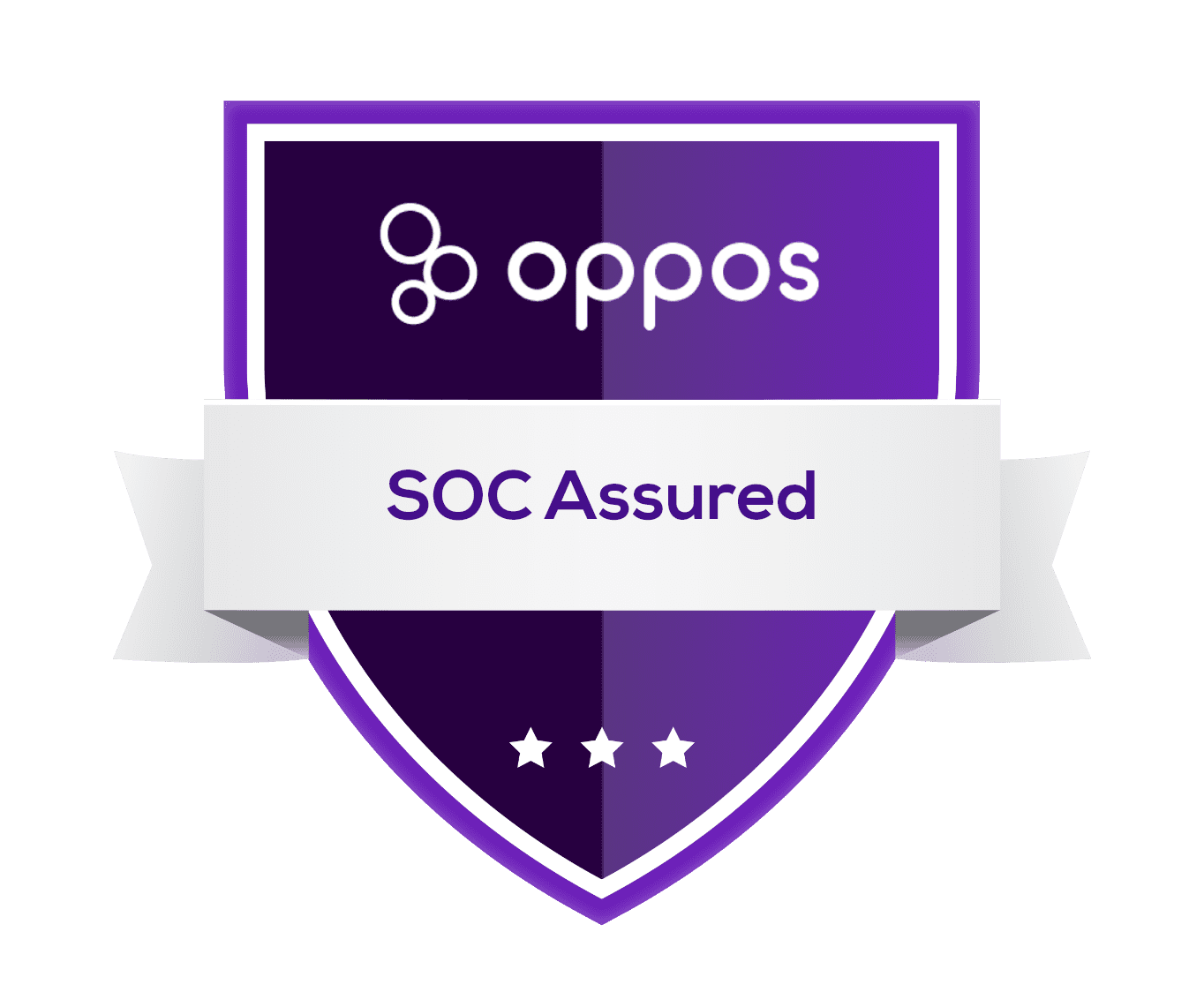

What to Expect for your SOC 1 Attestation Engagements

Undertaking a SOC 1 attestation engagement is a significant milestone for any service organization that deals with financial reporting and internal controls. North American businesses need to understand what this process entails to navigate it confidently and clearly. Here’s a concise guide to what your business can anticipate during a SOC 1 attestation engagement:

Initial Readiness Assessment

The journey begins with a readiness assessment, where a certified public accountant (CPA) evaluates your existing controls related to financial reporting. This phase is about identifying gaps and ensuring your organization’s system and controls are aligned with SOC 1 requirements.

Detailed Evaluation of Control Objectives

Expect a thorough review of your control objectives and the internal controls to achieve them. This includes assessing controls’ design and operating effectiveness over a specified period, ensuring they meet the standards for processing integrity, financial data accuracy, and security.

Rigorous Testing Procedures

A SOC 1 engagement is a demanding process where your service organization’s controls are tested extensively to ensure their effectiveness in practical situations. This is essential in proving to user entities and their auditors that your controls are functioning efficiently and can be trusted for precise financial reporting.

Management's Description of Controls

Your organization needs to create a comprehensive management description of the controls that are currently in place. This documentation is vital for the attestation report, as it clearly explains how your internal controls are designed and operated to achieve the related control objectives.

The SOC 1 Report

Upon completing our engagement, you will receive a SOC 1 report containing the auditor’s expert opinion on the control environment, the effectiveness of tested controls, and their performance during the specified period. This report is of utmost importance for user entities who want to ensure proper internal control over financial reporting. It also assures clients, stakeholders, and regulatory bodies about the controls’ efficiency and effectiveness.

Continuous Communication and Advisory

Expect continuous communication from your service auditor throughout the attestation engagement.

“A large Telco client of ours required Moveable Online undergo a PCI-DSS gap assessment. After asking around within our circle or business associates, we were introduced to Oppos. They were able to aid us with the gap assessment, make recommendations to secure our environment and help prepare the documentation our client required. The process was quick, informative and we will engage Oppos for future compliance related activities, primarily our efforts with achieving PCI-DSS compliance.”

“They weaved in a layer of security that we had only dreamed of in the past – a next generation rewall — which they built, congured and deployed at the perimeter of our network. When called upon, even with the great distance between us, they provide onsite or remote support as required and always meet the mark. Since the time of our initial project, we have called upon Oppos several times for various IT and Security related projects which they have delivered on every time.”

Partner with Oppos to Achieve SOC 1 Audit Compliance with Confidence

SOC 1 COMPLIANCE FAQS

SOC 1 attestation is an audit that assesses the internal controls of a service organization related to financial reporting. It ensures these controls are designed and operating effectively to safeguard client data and financial information, following the American Institute of Certified Public Accountants (AICPA) standards.

Businesses that provide services affecting their clients’ financial reporting must be SOC 1 compliant. This includes, but is not limited to, payroll processors, cloud service providers, and financial services companies. Compliance demonstrates the organization’s commitment to maintaining a secure and reliable control environment.

SOC 1 is not universally mandatory but becomes essential for service organizations that handle, process, or store information impacting their clients’ financial statements. Clients or partners in contracts often require it to ensure the service organization has adequate controls over financial reporting.

A SOC 1 report can only be issued by an independent CPA (Certified Public Accountant) or an accounting firm qualified to conduct these audits. The auditor assesses the service organization’s controls and provides an opinion on their effectiveness.

Not all companies have a SOC 1 report. Only service organizations that impact their clients’ financial reporting and choose to undergo this voluntary audit will have a SOC 1. It is specifically relevant for businesses whose services are integral to their clients’ financial operations and reporting.